Top of Mind Tuesday: When Your Government Customer Gets a New CEO

By Elizabeth B. Lippincott

Medicare Advantage (MA) organizations have a unique relationship with the federal government. Like all healthcare companies, they interact with the government as a regulator, the industry’s rule-maker and watchdog. This is a familiar aspect of the industry-government relationship, consistent with insurers’ experience with state and federal agencies in commercial lines of business.

The most successful MA plans, however, adopt a broader picture of their relationship with the government. The Centers for Medicare & Medicaid Services (CMS) is also their customer, a valuable and demanding public group health plan, responsible for safeguarding the benefits of tens of millions of Medicare beneficiaries administered by private insurers.

This shift in mindset to the government as customer alters the thinking around compliance within an MA organization. Compliance with the requirements of regulations and sub-regulatory standards isn’t just about staying out of legal trouble; it’s central to your plan’s success. The Affordable Care Act’s linkage of MA plan reimbursement to star ratings performance, including compliance measures, helped bring this reality into focus for business leaders in MA organizations. Regulatory standards and agency requirements are truly service level standards established by the customer and made part of the MA contract.

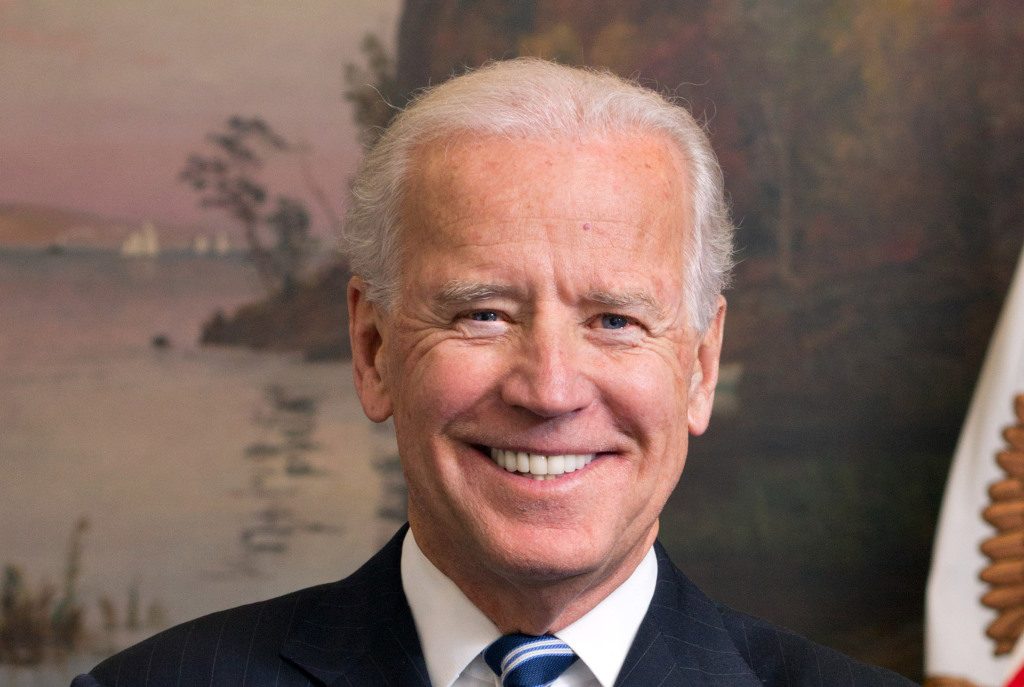

So what happens when your customer gets a new CEO, as the executive branch of the federal government will on January 20, 2021?

Approach the executive leadership transition the way you would if it were occurring with another significant group customer. Find out what you can about the new leader and the team they are putting together. What do you anticipate their priorities will be? Will they be sticklers for the requirements in your contract, which in the case of MA incorporates regulatory standards, ready to enforce any performance penalties at their disposal? (Yes.)

Here’s what we know about the incoming CEO and his team that bodes well for MA plans:

- President-elect Biden supports expanding the Medicare population by lowering the age of eligibility to 60 and letting people under 65 buy into the program. This could be a boon to MA plans.

- California Attorney General Xavier Becerra, Biden’s intended nominee for U.S. Secretary of Health and Human Services, has been active in efforts to protect the Affordable Care Act, which signals that expansion of health benefits will be a priority for the new administration.

- Becerra’s achievements in California included a $575 million settlement against a hospital system that required “all or nothing” clauses mandating that insurers contract with all of its facilities, suggesting a recognition of the role of health insurers in ensuring access to quality, affordable care.

That’s the good news. Based on our experience representing MA plans through multiple administration changes, we also urge insurers to get ready for an intensified oversight and enforcement environment. If anyone in your organization entered the MA market in the last four years, help them understand that their world is about to change. They will have new challenges, in addition to new opportunities.

What can you do now to get ready?

- Know your organization’s weaknesses. Conduct an especially thorough compliance program effectiveness audit in 2021, as early in the year as possible. Examine operational metrics to identify areas that need to improve and be prepared show that you are working diligently to fix problems.

- Assess contractual risks. The OIG released two significant changes to the Safe Harbor regulations under the Anti-Kickback Statute on November 30 and December 2, 2020, including new provisions governing value-based arrangements. Review risk or outcomes-based provider contracts to see how well they align with the new regulations and evaluate what changes could be made to mitigate legal risks.

- Be ready for change. The first thing you notice may be the intensity of enforcement of existing laws and rules. Then, we expect proposed regulatory changes as well as potentially significant healthcare legislation. Your organization needs to be prepared to respond to rapidly changing conditions.

We expect 2021 to be an exciting year for MA organizations, with new opportunities as well as risks.