Top of Mind Tuesday: What Does the Regulatory Freeze Mean for Medicare Advantage?

By Sandra Durkin

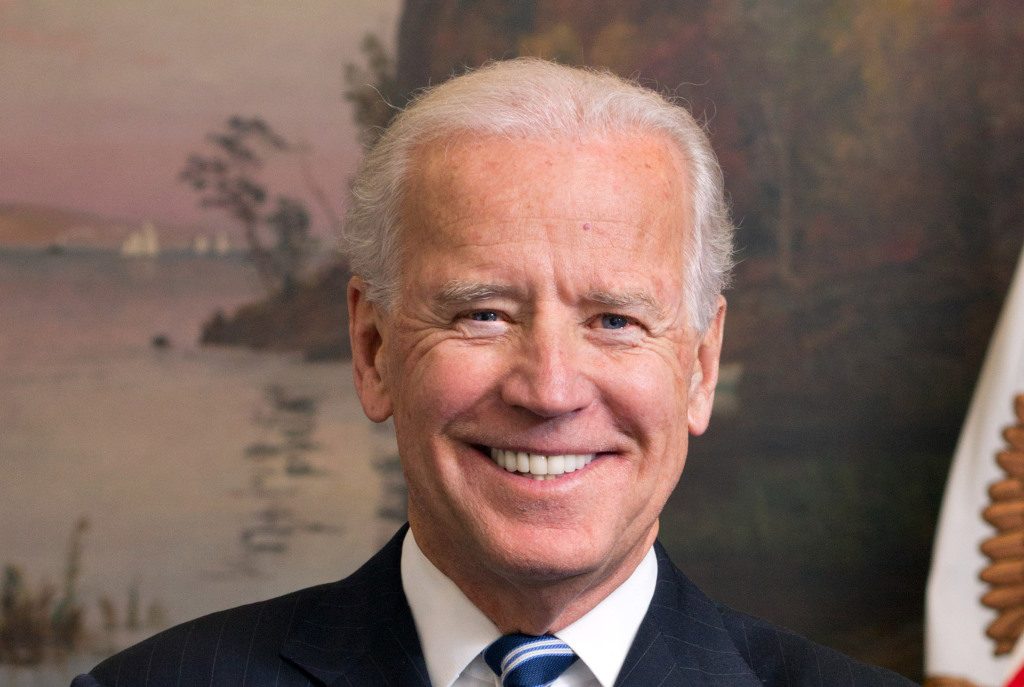

We witnessed a peaceful transfer of presidential power in the United States last week. Following an inauguration in which President Biden pledged to take on a “raging virus” and “make health care secure for all,” the new administration dug in and got to work. Indeed, on the first day in office, President Biden issued seventeen executive orders, memoranda, and proclamations covering issues ranging from the environment to immigration to the economy.

Here at Strategic Health Law, we are keeping our eyes on one particular presidential action that has the potential to impact our health plan clients with government lines of business—namely, the “regulatory freeze” on rules and guidance initiated and, in some cases, released by the preceding administration. The scope of the regulatory freeze is outlined in a memo from White House Chief of Staff Ronald A. Klain to the heads of executive departments and agencies. Specifically, President Biden instructed agencies to: (1) refrain from proposing or issuing any new rules until they have been reviewed and approved by the President’s newly appointed or designated department and agency heads; and (2) withdraw all rules submitted but not yet published in the Federal Register to undergo the same review and approval. Additionally, with regard to rules that have been published but have not yet taken effect, the memo recommends that (3) agencies consider postponing the rules’ effective dates for 60 days to allow for further review and, where appropriate, a 30-day comment period. If an agency identifies substantial questions of fact, law, or policy in any rule, the agency may delay implementation beyond the 60-day period to resolve those issues.

Healthcare organizations will not have missed that the Department of Health and Human Services (HHS) stayed active throughout 2020, issuing a significant volume of regulations and sub-regulatory guidance to address issues raised by the global health pandemic (e.g., expanding telehealth) as well as more routine issues (e.g., bid guidance for Medicare Advantage (MA) organizations). HHS’s efforts included a string of substantive regulations issued in the final months and weeks of the Trump administration, including:

- The final rule eliminating safe harbor protections under the Anti-Kickback Statute (AKS) for drug rebates published in the Federal Register on November 30, 2020;

- The final rule expanding and modifying safe harbors and exceptions to the AKS to promote value-based and coordinated care published in the Federal Register on December 2, 2020;

- The 2022 MA and Part D final rate notice announced on January 15, 2021 (much earlier than in previous years); and

- The final rule for MA and Part D published on January 19, 2021.

Which of these regulatory actions—each of which has direct, substantial impacts on MA organizations and their partners—are affected by the regulatory freeze? On this list, only the final rule amending the AKS safe harbors to protect, among other things, value-based arrangements and coordinated care is wholly outside the scope of the White House memo because it went into effective on January 19, 2021, the day before the presidential transition. This is a positive for industry stakeholders who have been driving the transition to value-based care for years and for whom safe-harbor protections for innovative arrangements are long overdue.

As to the remaining items, they are all potentially subject to the recommended delay and further review. Ultimately, it is up to HHS and its agencies to decide whether any of these rules should be postponed and subject to additional review and comment, but we can make some predictions based on the nature and context in which the rules were promulgated.

The most significant—and most controversial—portion of the rebate rule, which removes safe harbor protections for payments between drug manufacturers and plan sponsors or their PBMs, goes into effect on January 1, 2022. The rule was originally withdrawn after proposal in 2019 and only finalized after President Trump issued an executive order directing HHS to remove rebates from the discount safe harbor. The rule has already been challenged in a lawsuit alleging, among other things, that it violates notice and comment rulemaking requirements. Given the bumpy road this rule has traveled and the drastic change it will impose on the industry, it will almost certainly be subject to further review by HHS and OIG and would benefit from an additional comment period for stakeholders.

The final rule for MA and Part D, which is actually the second final rule coming out of a rule that was proposed in February 2020, is considerable in scope with many substantive changes to the Part C and Part D programs (e.g., requiring Part D plans to offer real-time comparison tools; permitting a second, “preferred” specialty tier in Part D, establishing pharmacy performance measures reporting requirements; and implementing several opioid provisions of the SUPPORT Act). Given the lapse in time between the proposal and the final rule, the timing of its issuance so close to inauguration, and its broad scope, this rule also seems likely to be subject to delay and further review by CMS.

Finally, the MA and Part D rate announcement issued on January 15, 2021, is also potentially subject to delay and review under the White House Memo, which not only encompasses rules published in the Federal Register, but also “any agency statement of general applicability and future effect that sets forth a policy on a statutory, regulatory, or technical issue.” CMS finalized this rate announcement in mid-January, though typically the MA and Part D rates are proposed in February and finalized in April. Though health plans would benefit from the additional time to prepare their Medicare bids before June, we would not be surprised to see CMS review the rate announcement given its timing and scope.

The rules touched on here are a tiny fraction of the actions encompassed by the regulatory freeze, which will require a massive effort by administrative agencies and staff, and their review will be conducted in tandem with efforts to implement President Biden’s healthcare agenda. One thing healthcare companies and workers can count on, is that this year will be just as busy as last.