New Administration’s Focus On Fraud Likely to Lead to Continued Scrutiny of Medicare Advantage Risk Adjustment

Health plans wondering what type of oversight to expect from the new administration can anticipate continued scrutiny of risk adjusted payments to Medicare Advantage organizations. While Trump has said that he will “love and cherish” Social Security and Medicare and does not plan on cuts to those programs, he more recently caveated that cuts could come if the administration finds abuse or waste.

The IRA’s Inadvertent Boost of Medicare Advantage

The Inflation Reduction Act Part D redesign was not intended to boost enrollment in Medicare Advantage plans, but that is a likely outcome of the IRA’s changes to Part D. The IRA statutory language capped increases in a Part D premium benchmark at 6% per year, but did not cap the actual premium that members would have to pay. We suspect that legislators did not understand that actual member premiums could go up much more than 6% annually under the IRA’s Part D provisions as a result of benefit enhancements, including capping out-of-pocket costs at $2,000 annually.

OIG Continues to Challenge MAO use of HRAs; CMS Continues to Reject Recommendations to Restrict Use

In a report issued in October 2024, the Office of Inspector General (“OIG”) within the Department of Health and Human Services (“HHS”) expressed concern that health risk assessments (“HRAs”) and chart reviews used by Medicare Advantage organizations (“MAOs”) are being misused to drive up payments from the government, rather than to improve member care.

New DOJ Whistleblower Program for Commercial Fraud Reports

On August 1, 2024, the U.S. Department of Justice (DOJ) introduced its Corporate Whistleblower Awards Pilot Program, a three-year program designed to fill gaps in federal agency whistleblower programs. A key function of this new program is to bolster enforcement of misconduct that is not prosecutable under the False Claims Act (FCA). The FCA only imposes liability for fraud against the federal government, which creates a gap in enforcement for fraud against other organizations or individuals. The Whistleblower Pilot Program targets misconduct against non-federal government organizations or individuals, such as private payors or patients.

CMS Updates ODAG/CDAG Guidance for MA and Part D Plans

On July 18, 2024, the Centers for Medicare & Medicaid Services (CMS) published an update to the Parts C & D Enrollee Grievances, Organization/Coverage Determinations, and Appeals Guidance (Updated Guidance). CMS had not updated guidance for organization determinations, appeals, and grievances (ODAG) in the Part C program and coverage determinations, appeals and grievances (CDAG) in the Part D program since 2019. The Updated Guidance reflects recent changes to the regulations governing ODAGs, clarifications on the role of representatives in the ODAG/CDAG process, and terminology changes to align with updated regulations.

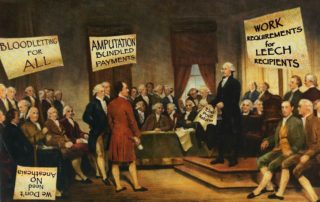

The Regulatory Pendulum Is in Full Swing for Medicare Plans: Five Things You Can Count on in a Dynamic Regulatory Environment

The pendulum of the Medicare plan regulatory environment—which grew increasingly stringent under the Biden administration—probably reached its amplitude in the last few weeks and began to swing in the opposite direction. Having seen several oscillations of this political pendulum, I wanted to share some insights about what these changes mean for Medicare plans, as well as what lawyers and business teams can count on to stay constant.

BREAKING NEWS

A Texas District Court has stayed the implementation of the Medicare Advantage and Part D agent compensation provisions of the CY 2025 Final Rule for all affected parties.

2025 MA and Part D Final Rule Released

On April 4, 2024, CMS released the unpublished PDF version of the Contract Year 2025 Medicare Advantage and Part D Final Rule (CMS-4205-F). The Final Rule contains numerous new requirements that were not included in the proposed rule from November 2023, expanding the rule to 1,327 pages. CMS dusted off a lot of earlier proposals and finalized them for 2025. Here is the initial unpublished PDF. It is scheduled to be published in the Federal Register on April 23, 2025.

CMS Interoperability and Prior Authorization Final Rule Impacts for MA

The CMS Interoperability and Prior Authorization Final Rule (CMS-0057-F) includes a series of changes meant to streamline prior authorization and advance interoperability. Impacted payors include Medicare Advantage (MA) organizations, state Medicaid and CHIP Fee-For-Service programs, Medicaid managed care plans, CHIP managed care entities, and Qualified Health Plan issuers on the Federally Facilitated Exchanges. Most of the Final Rule’s changes become effective in 2026, with the new API standards generally going into effect in 2027.

Elizabeth Lippincott will be Presenting at the AHLA Institute on Medicare and Medicaid Payment Issues

Elizabeth Lippincott will be speaking at the AHLA Institute on Medicare and Medicaid Payment Issues on March 21, 2024 I Baltimore, Maryland.